One of the most important, and complicated, issues you need to think about when you are getting a divorce in Illinois is maintenance. (In Illinois, alimony/spousal support is known as “maintenance.”)

No matter what Illinois divorce process you use, figuring out whether you may be entitled to get maintenance, or may have to pay maintenance, in Illinois is a three-step process.

First, you have to determine whether maintenance is appropriate in your particular divorce case. You do that by considering the factors that are in the Illinois Maintenance law.

If maintenance/alimony is appropriate in your divorce, then you apply a guideline formula to figure out how much may be paid/received.

Then you apply a guideline formula to figure out the length of time for which maintenance may be paid/received.

While it is possible to deviate from guideline support, judges will usually follow the guidelines set forth in the statute unless the parties agree otherwise, or there is a really good reason for the deviation.

How to Figure out Alimony in Illinois

Step #1: Is Maintenance Appropriate in Your Divorce?

To figure out whether maintenance will even be considered in your divorce, you need to look at many different factors. In general, these factors are:

- Each spouse’s income and property (“Property” includes both marital and non-marital property);

- Each spouse’s needs;

- How much each spouse could realistically earn;

- Whether the spouse who is seeking maintenance is making less money because s/he was a stay-at-home parent or delayed his/her own education, training, employment, or career opportunities due to the marriage;

- Whether the earning capacity of the spouse who would be paying maintenance is or may be impaired;

- The time it would take the spouse seeking maintenance to get education, training, and a job.

- The standard of living established during the marriage;

- The length of the marriage;

- The age, health, station, occupation, vocational skills, employability, sources of income, liabilities and needs of each spouse;

- All sources of public and private income including disability and retirement income;

- The tax consequences of the property division in the divorce;

- How much the spouse seeking maintenance contributed to the education, training, career, or license of the other spouse;

- The terms of any valid prenuptial agreement; and

- Any other factor that the court expressly finds to be just and equitable.

As you can see, there’s a lot involved in figuring out whether your divorce will involve maintenance. What’s more, courts have a lot of discretion when considering these factors. That means that determining whether your case will involve maintenance is NOT always easy and it's NOT always clear!

To get more information on whether maintenance may be a factor in your divorce, check with a local Illinois divorce lawyer. To view the exact language of the Illinois maintenance statute, CLICK HERE.

Step #2: How Much Maintenance Should You Pay/Get?

Once you find that maintenance is appropriate in your case, step two is to calculate how much maintenance should be paid/received.

In Illinois, maintenance is now calculated based on your NET income and your spouse's NET income. The Illinois guideline maintenance formula stated below applies in any case where the combined net income of you and your spouse is LESS THAN $500,000. If your combined net income exceeds $500,000 you need to speak with an Illinois divorce attorney to help you calculate what maintenance may be in your particular case.

The Illinois guideline maintenance formula is 33% of the payor’s NET income, minus 25% of the payee’s NET income. However, the total amount the payee receives can’t be more than 40% of the parties’ combined net incomes.

Calculating Illinois maintenance is a three-step process.

The easiest way to understand the Illinois maintenance formula is to apply an example to it.

Example #1

Step 1: Calculate the 33% - 25% of the net income amount.

Let’s say the person who will pay spousal support makes $90,000 NET income per year and the person who will receive that support makes $30,000 NET income per year. The maintenance calculation would look like this:

$90,000 x .33 = $29,700

-$30,000 x .25 = 7,500

Maintenance = $ 22,200 … But you can’t stop your calculation here. You MUST go to steps 2 and 3.

STEP 2: Calculate 40% of the combined net incomes.

Here’s the calculation to figure that out:

$120,000 Combined net incomes ($90,000 + $30,000)

x .40 (40%)

= $48,000 (maximum amount of income the receiving spouse can have when you add his/her earnings plus maintenance.)

STEP 3: Calculate guideline maintenance.

$30,000 (Receiving spouse’s income)

+22,200 (Maintenance based upon Step 1)

=$52,200 - Since this is MORE than 40% of the combined net incomes, the MOST maintenance the receiving spouse can get is calculated as follows:

$48,000 (40% of combined net incomes)

-30,000 (receiving spouse’s net income)

$18,000 – Guideline Maintenance Amount

Example #2

Step 1: Calculate the 33% - 25% of the net income amount.

Let’s say the person who will pay spousal support makes $250,000 NET income per year and the person who will receive that support makes $30,000 NET income per year. The maintenance calculation would look like this:

$300,000 x .33 = $99,000

-$30,000 x .25 = 7,500

Maintenance = $ 91,500 … But you can’t stop your calculation here. You MUST go to steps 2 and 3.

STEP 2: Calculate 40% of the combined net incomes.

Here’s the calculation to figure that out:

$330,000 Combined net incomes ($300,000 + $30,000)

x .40 (40%)

= $132,000 (maximum amount of income the receiving spouse can have when you add his/her earnings plus maintenance.)

STEP 3: Calculate guideline maintenance.

$30,000 (Receiving spouse’s income)

+91,500 (Maintenance based upon Step 1)

=$122,500 - Since this is LESS than 40% of the combined net incomes, the receiving spouse will get the whole amount of $91,500. Here's the calculation

$132,000 (40% of combined net incomes)

- 30,000 (receiving spouse’s net income)

$102,000 – Maintenance can not be more than this amount.

As you can see, this calculation can get complicated! It can get even more complicated because what is considered to be "net income" depends on what you deduct from your "gross income."

Running the calculation set out above can give you a rough idea of what you might owe or be entitled to get in maintenance. But because this calculation can be so tricky, it's best to have an Illinois divorce lawyer or an Illinois divorce financial planner run more precise calculations for you.

Step #3: How Long Should Maintenance Be Paid?

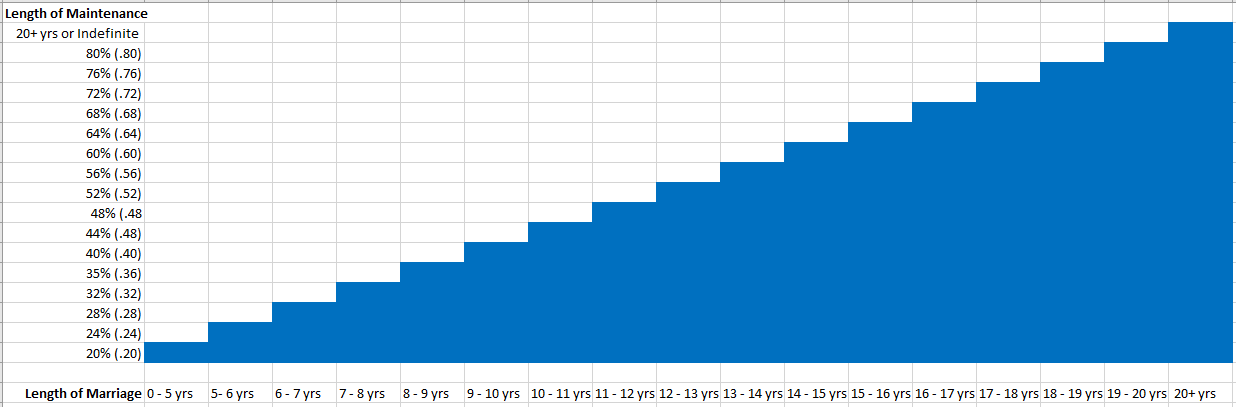

Just like there is a formula for figuring out how much maintenance should be paid, there is also a formula for how long maintenance should be paid.

The length of time you will pay or receive maintenance depends on how long you were married.

Multiply the length of your marriage (from the day you were married until the day you or your spouse filed for divorce) by the appropriate factor:

- less than 5 years (.20);

- 5 > 6 years (.24);

- 6 > 7 years (.28);

- 7 > 8 years (.32);

- 8 > 9 years (.36);

- 9 > 10 years (.40);

- 10 > 11 years (.44);

- 11 > 12 years (.48);

- 12 > 13 years (.52);

- 13 > 14 years (.56);

- 14 > 15 years (.60);

- 15 > 16 years (.64);

- 16 > 17 years (.68);

- 17 > 18 years (.72);

- 18 > 19 years (.76);

- 19 > 20 years (.80).

For a marriage of 20 or more years, maintenance lasts either as many years as the marriage, or for an indefinite term.

NOTE: You calculate the length of the marriage from the date of your marriage to the date someone filed for divorce NOT the date your divorce is final.

Alimony in Illinois: It’s Complicated!

Figuring out alimony in Illinois isn’t easy! Not only can the calculations be tricky, but what’s even more confusing is that these calculations are only GUIDELINES.

What does that mean?

It means that the court has the discretion to vary from those guidelines in appropriate circumstances. An Illinois judge can award more, or less, maintenance than the guidelines require.

If a judge does vary from guideline maintenance/support s/he must state the reasons for the deviation.

As always, the best way to know whether maintenance will be a factor in your divorce, as well as how much may need to be paid, and for how long it may need to be paid, is to talk with a good Illinois divorce lawyer near you.