Divorce law is state-specific. Knowing the divorce law in your state is important. If you are getting a divorce in Illinois, here are answers to some of the most common questions that people have about Illinois family law.

Contents

(Questions are grouped by topic area. Choose the area that most closely relates to your questions.)

- How to get a divorce in Illinois (The Illinois Divorce Process);

- Your rights and responsibilities in an Illinois divorce (Illinois Divorce Law);

- Working with divorce lawyers in Illinois (Illinois Divorce Lawyers);

- Child Support, “Custody” and Parenting Time in Illinois (Divorce and Children in Illinois); and

- Maintenance (a/k/a “Alimony”) in Illinois (Alimony in Illinois); and

- Generally Asked Questions (Other Illinois Family Law Questions).

Illinois Divorce Process

1. Is Illinois a no fault state?

Yes. The only grounds for divorce in Illinois today are irreconcilable differences. There is no fault involved in having “irreconcilable differences.”

What’s more, what you or your spouse did during your marriage generally has no effect on how your property gets divided. (There may be some exceptions to this. If you have questions, ask your Illinois divorce lawyer.)

What that means is that it doesn’t matter if your spouse lied, cheated, or wasted your money. Your marital assets will still be divided equitably.

2. How long do my spouse I need to be separated before we can get a divorce in Illinois?

Illinois has NO waiting period for divorce IF you and your spouse agree that you have irreconcilable differences.

If you and your spouse DON’T agree that you have irreconcilable differences, then you have to be separated for six months before you can get a divorce.

The good news (if you’re the one who wants to divorce) is that after you’ve been separated for a period of six months, the law presumes that you have irreconcilable differences. That means that, after you and your spouse have been separated for six months, you WILL be able to get a divorce – whether your spouse agrees or not.

You can be living in the same house and still be deemed to be living “separate and apart,” as long as you are no longer living together as man and wife.

NOTE: You can FILE for divorce whenever you want. You just can’t finalize your divorce unless your spouse agrees or until you’ve been separated for six months.

3. How much does it cost to get an uncontested divorce?

The court filing fee you will pay to get divorced depends on the county where your case was filed. To discover what your county's filing fees are, check out the website for the Clerk of the Court in your county.

Your court filing fee is the same whether your divorce is contested or uncontested. What changes dramatically in an uncontested divorce is the amount of attorneys’ fees you will pay.

Most Illinois divorce lawyers charge by the hour. Since uncontested divorces take less time and effort than contested divorces, your attorneys’ fees in an uncontested divorce will generally be a LOT lower in an uncontested divorce in Illinois than they will be if you fight.

4. What is a legal separation in Illinois?

Unlike a divorce, a legal separation doesn’t end your marriage. It can, however, divide marital property between spouses IF BOTH SPOUSES AGREE. If the spouses don’t agree, their property can’t be divided in a legal separation.

In a legal separation, a court can order one spouse to pay maintenance (support) to the other.

In the past, there were two main reasons people filed for a legal separation instead of a divorce:

a. So that they could keep their spouse on their health insurance;

b. For religious reasons.

Today, many health insurers will not continue to afford coverage to a spouse is legally separated.

Because of its limited scope, very few people file for a legal separation in Illinois today.

5. How do I get an annulment in Illinois?

An annulment treats your marriage as if it never even happened. There are very limited grounds upon which you can get an annulment in Illinois. Those grounds are:

- One spouse lacked the capacity to consent to the marriage. For example, if someone didn't have the mental capacity to understandwhat s/he was doing, then his/her marriage can be annulled. Or, if someone was under the influence of alcohol, drugs, etc., at the time of the marriage. then s/he may have lacked the capacity to consent to the marriage. Also, if someone was induced to enter into a marriage by force, duress, or fraud, s/he may not have “consented” to the marriage.

- One spouse didn’t have the physical capacity to consummate the marriage by sexual intercourse and the other party didn’t know that at the time of the marriage.

- Either (or both) of the spouses was only 16 or 17 years old and didn’t have his/her parents’ or guardian’s consent to get married; or

- The marriage was prohibited. (For example, you can’t marry someone who is already legally married to someone else.)

(NOTE: Legally annulling your marriage does NOT necessarily annul your marriage religiously. Religious annulment is a whole separate thing! If you are looking for a religious annulment, talk to your priest, rabbi, minister, immam, or appropriate religious official.)

6. If my spouse and I agree on everything, do we still have to go to court in order to get divorced in Illinois?

Usually, yes.

Before CoVid either you or your spouse had to appear in court in person at your final divorce hearing in order to finalize your divorce.

Now, many courts are doing uncontested divorce hearings via Zoom. In some counties you may even be able to get divorced simply by filing all the appropriate, signed paperwork with the judge. (i.e. You won't have to appear in front of a judge at all in order to get divorced.)

Check with your Illinois divorce lawyer to find out what the rules are in your county.

NOTE: Both you and your spouse have the right to be at your final divorce hearing if you want. But only one of you MUST show up.

7. I don’t want a divorce, but my spouse does! How can I stop my spouse from divorcing me in Illinois?

You can’t.

If your spouse wants a divorce, and you've been separated for six months or more, the court WILL divorce you - whether you want a divorce or not.

(Sorry!)

8. How does divorce mediation in Illinois work?

You and your spouse can mediate any or all issues in your divorce. You can also usually go to mediation at any time during your divorce, so long as you and your spouse agree.

During mediation, a trained, independent, neutral mediator will help you and your spouse talk to each other. S/he will also help you resolve whatever issues you disagree about.

If you want, your lawyers can go with you to mediation. ( That's called "lawyer-assisted mediation.") Or you can mediate without your lawyers being present.

Even though you mediate your divorce, it is wise to talk to a lawyer BEFORE you mediate. That way you will fully understand your rights and responsibilities BEFORE you agree to anything. (Yes. You need a mediator and a lawyer!)

NOTE: A mediator cannot force you to make an agreement. If you and your spouse don’t agree, then the mediation is said to have “failed” and you and your spouse will then go back to court.

9. Can the court ORDER my spouse and I to go to mediation in Illinois?

Yes. In Illinois, a court can ORDER you and your spouse to go to mediation. The court can order you to mediate your financial issues, your parenting issues, or both. What the court CAN'T order you to do, though, is to make an agreement during mediation.

If you and your spouse don't come to a settlement at mediation, your mediation will fail and you have to go back to court. Then the judge will decide your divorce for you at a trial.

It's also worth noting that judges will often order you to mediate the issues surrounding your children (i.e. your parental responsibilities) BEFORE they will give you a hearing date on those issues. That's because the judges would rather have you decide how you want to parent your kids yourselves (if that's possible).

Finally, depending upon the county in which you live, a limited amount of mediation regarding parenting issues may or may not be provided to you free of charge. HOwever, if you want to mediate any financial issues in your divorce, you generally have to pay for that yourself.

10. I’ve heard about Collaborative Divorce, but I don’t really understand what that means. What is an Illinois Collaborative Divorce?

Collaborative Divorce means much more than that you and your spouse want to divorce amicably, or collaboratively.

Collaborative Divorce is a specific type of divorce process that is designed to help you and your spouse resolve all of your divorce issues in a conference room instead of a courtroom.

In Collaborative Divorce specially trained divorce professionals, including divorce lawyers, coaches, child specialists, and neutral divorce financial professionals, help you and your spouse focus on what matters most to you and end your marriage respectfully.

The hallmark of a Collaborative Divorce is that everyone (including the divorce professionals) signs an agreement in the beginning of the divorce process that says that, if the Collaborative Process doesn’t work, all of the professionals will withdraw from the case. The divorcing couple then has to hire new professionals and start all over again if they want to go to court.

The purpose of this agreement is to make sure that everyone is incentivized to stay at the table and negotiate in good faith. (Normally, lawyers make more money when you fight. In a Collaborative Divorce, if you end up fighting in court, the Collaborative lawyers lose you as a client!)

In 2017, Illinois passed the Illinois Collaborative Practice Act. This law governs how Collaborative Divorce in Illinois is done.

11. How do I complete my Illinois Financial Affidavit?

Theoretically, everyone who wants to get divorced in Illinois needs to fill out an Illinois Financial Affidavit. This affidavit is essentially a budget and a balance sheet.

In this Affidavit, you will have to list information about how much money you and your spouse make, what you spend, what you own and what you owe.

You can get a copy of the Illinois Financial Affidavit online. All counties in Illinois now use the same Financial Affidavit.

Filling out the Illinois Financial Affidavit can be confusing! Illinois Legal Aid Online has a fabulous website that will help you complete your Financial Affidavit. CLICK HERE to check it out.

12. My spouse doesn't live in Illinois. Can I still get an Illinois divorce?

In order to be able to get a divorce in Illinois, either you or your spouse must have lived in the state of Illinois for at least 90 days before one of you filed for an Illinois divorce.

If you live in Illinois, but your spouse does not, you can still file for divorce in Illinois. But you will have to serve your spouse with a Summons and a copy of the Petition for Dissolution of Marriage that you have filed in the place where your spouse lives. The best way to do that is to talk to a lawyer in your area about how to do it properly.

If you’re trying to get your spouse served with a Summons outside of the state of Illinois and you don’t have a lawyer, try talking to someone at your County Sheriff’s department. They should be able to tell you the steps you need to take to make that happen.

Illinois Divorce Law

1. My spouse cheated on me. How do I get a divorce based upon adultery in Illinois?

Illinois no longer allows divorces based upon anything other than irreconcilable differences. So, you can’t get a divorce based upon adultery in Illinois.

2. My spouse has a mountain of student loan debt. Will I be responsible for paying for my spouse’s student loan debt in my Illinois divorce?

That depends on when the debt was incurred and what it was incurred for.

Debt that your spouse incurred before you were married is generally your spouse’s separate debt. So, technically, your spouse’s premarital student loans should be your spouse’s responsibility after your divorce. (That is, unless you agree to pay them as part of your divorce settlement.)

If your spouse took out student loans WHILE you were married, however, the answer could be different. If your spouse used the loans to pay for his/her tuition, books and fees, then that debt, too, may be deemed to be your spouse's sole responsibility. But if your spouse took out loans and then the two of you used that money to live on while your spouse was going to school, then those loans may be deemed to be marital debt.

If the student loans are determined to be marital debt then both you and your spouse may be responsible for paying those loans after your divorce.

3. In Illinois, am I entitled to get part of my spouse’s retirement account in our divorce?

All property that you or your spouse earned or acquired from the date of your marriage forward is generally marital property. So, if your spouse contributed to a retirement account while you were married, those contributions (as well as the employer's matching contributions) will likely be marital property.

Marital property is divided equitably in a divorce. (See the next question and answer, below.)

There are some exceptions to the rule, though. Any property your spouse got through a gift or inheritance, even during your marriage, is usually considered to be your spouse’s separate, non-marital property. (So, if your spouse funded his/her IRA with inherited funds, then that IRA may NOT be marital property.)

Also, if you and your spouse entered into a valid pre-marital agreement that said that money in a retirement account is NOT to be considered as marital property, then the money in your spouse’s retirement account may be non-marital.

The issue of whether property is marital or non-marital can be complicated. If you have questions about this, it’s best to consult with a lawyer in your area.

4. How is property divided in an Illinois divorce?

In Illinois, property in a divorce is divided equitably. It is not necessarily divided equally.

What does dividing property “equitably” mean?

Generally speaking, dividing property "equitably" means dividing it "fairly."

What is "fair?"

That depends on all of the facts and circumstances in your case, as well as what the court thinks is “fair.” (NOTE: What the court thinks is equitable may be very different from what you think is equitable! To figure out what is equitable in your divorce, it’s best to talk to a divorce attorney in your area.)

5. Is an inheritance considered marital property in Illinois?

Money that you inherit and money that you receive as a gift is not considered to be marital property in Illinois. However, if you deposit your inheritance into a joint bank account with your spouse, then you may be deemed to have “made a gift” to the marriage.

Also, once you spend your inheritance to pay marital bills, it’s gone. You are generally not entitled to get reimbursed by the “marital estate” if you divorce.

The issue of what is and is not marital property in Illinois can be complicated. If you’re not sure whether what you own is marital property, the smartest thing you can do is to consult with an Illinois divorce attorney. S/he should be able to answer any questions you may have.

Illinois Divorce Lawyers

1. Can I get a divorce without a lawyer in Illinois?

Yes, you can.

The better question is: Should you get a divorce without a lawyer? (In most cases, the answer to THAT question is No! … at least, not if you have anything you don’t want to lose.)

2. My spouse and I both want an amicable divorce. Can we both use the same Illinois family lawyer to handle our divorce?

No.

No lawyer, in Illinois or any other state, can represent BOTH you and your spouse in the same case. When you hear people say, “We used the same lawyer,” what that really means is the lawyer represented one of them and the other one went without a lawyer.

3. Can I get my spouse to pay my divorce lawyer’s fees in Illinois?

Yes, but it’s not automatic and it's not always easy.

Years ago, Illinois adopted laws aimed at “leveling the playing field.” Those laws allowed one spouse to get attorney’s fees from the other spouse, both during the divorce and at the end of the divorce.

But NO ONE wants to pay their spouse’s attorney’s fees in a divorce! So, most people fight having to pay their spouse’s fees.

If you and your spouse can't agree on who pays the attorney's fees in your divorce, then that will be an issue for the judge to decide. (NOTE: Granting attorney's fees is generally in the judge's discretion. That means the judge doesn't HAVE to grant you or your spouse attorney's fees.)

4. If my spouse and I are mediating our Illinois divorce, do we still need lawyers?

Yes! Mediators are neutral. They can’t give you legal advice, even if they are lawyers!

In most cases, mediators won’t draft all of your legal documents either.

At the end of your mediation, the mediator will usually write up everything you agreed to into a mediated settlement agreement. That agreement may form the basis for your Marital Settlement Agreement, but it may not contain every single provision your Marital Settlement Agreement needs. What’s more, your Settlement Agreement is only one of the documents you will need in your divorce.

A mediator will also not file your documents in court for you. A mediator will not appear in court with you. Those are things that only an Illinois divorce lawyer can do for you.

5. How do Illinois Family Law lawyers charge?

Most Illinois family lawyers charge by the hour for the work they do. They take a retainer from you upfront. A retainer is like a deposit you pay them. Then the lawyers bill by the hour against the retainer.

When your retainer has been used up, your Illinois divorce lawyer will either ask you for another retainer or will expect you to pay your bill monthly when it is due.

Some attorneys will charge a flat fee for a simple uncontested divorce. But, if you later start to fight, you will also start to pay that lawyer by the hour for his/her time.

Divorce and Children in Illinois

1. My spouse and I are getting a divorce, but we agree on everything regarding our kids. We both want what’s best for them. Do we still have to go to Parenting Class?

Yes! All divorcing parents in Illinois have to attend a parenting education class. Those classes are held both in-person and online.

It is VERY important that you take the parenting class that YOUR COUNTY requires. If you take the wrong parenting class, you may have to go back and take the right one before you can get divorced! Here are links to some Illinois Parenting Classes:

For parenting classes in any other county, check with your local clerk of the court or an attorney in your county to find the right parenting class for you.

2. In an Illinois divorce, will my children get a say in who they want to live with? If so, how old do they have to be before they can decide who they want to live with?

Children of divorcing parents do not get to decide which parent they will live with until they are 18 years old. Then they are legally adults and can live where ever they want.

Courts do not want to put children in the middle of their parents’ divorce. That’s why they don’t allow children to decide which parent they want to live with.

Sometimes, in rare cases, a judge will get a child’s input about where s/he wants to live. But, even if a judge does that, s/he will usually make it clear to the child that, even though he is asking for the child’s opinion, it is the JUDGE’S decision where that child will live after the divorce.

3. What happens in Illinois if my partner and I never married but we have kids together? Are the rules for unmarried parents in Illinois different than they would be for divorcing parents?

The rules surrounding parental responsibilities, parenting plans, child support, and parenting issues are the same for unmarried parents as for divorcing parents.

4. How do I calculate child support in Illinois?

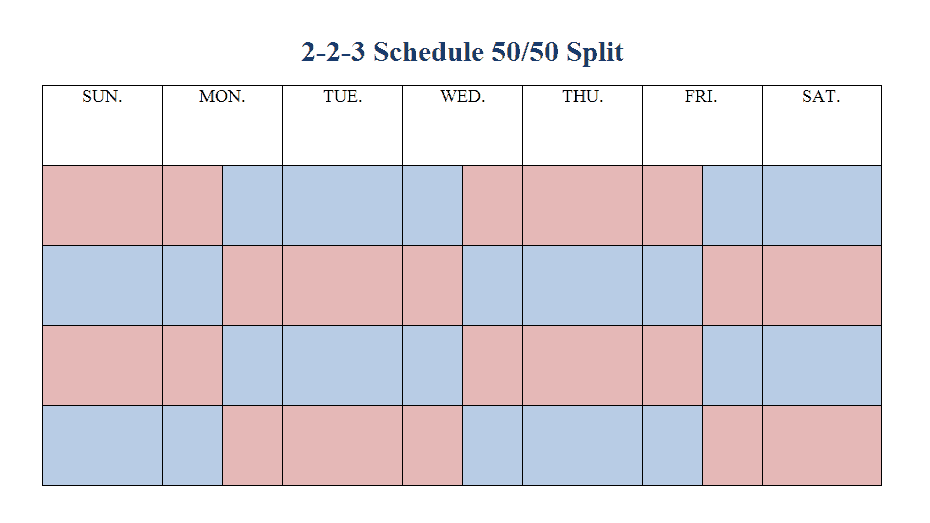

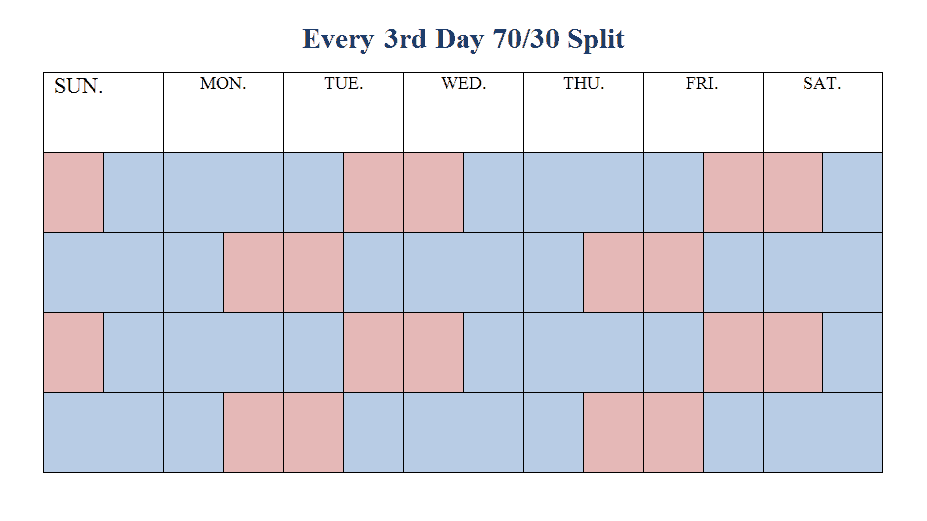

Like in other states, Illinois child support is based upon a guideline calculation. The calculation is based on BOTH parents' net incomes and will apply in most cases. The calculation also takes into account the amount of time that each parent spends with a child. "Time with a child" is based upon the number of overnight visits a parent has with his/her child.

If a parent spends at least 146 overnights with their children, then the amount of child support that parent would otherwise pay is reduced due to the amount of time the parent spends with the kids.

However, it is possible, in certain circumstances, to set child support at an amount greater than or less than the guideline amount.

Deviating from the guideline amount of child support in most cases is RARE! If you want to do it, you must have a very good reason for doing it AND you must get your judge to agree that there is a good reason for deviating from the guidelines.

NOTE: The fact that you may be unemployed, or don’t have a lot of money, is usually NOT a good reason for deviating from the child support guidelines! HOWEVER, if you're a very high earner, and the amount of guideline child support would be way more than what it would take to reasonably support your child, then a court may order you to pay a lesser amount of child support than what the guidelines would otherwise require.

If you want to get a rough idea of what your child support might end up being, you can check out this Illinois child support estimator.

5. How does child custody work in Illinois?

Illinois has abolished the term “custody.” It has replaced the concept of “child custody” with “Parental Responsibilities.” (See the answer below.)

6. What are “Parental Responsibilities” in Illinois family law?

Divorcing Illinois parents have five areas of responsibility when it comes to their children:

- Decision making regarding:

- Education;

- Health care;

- Religion; and

- Extra-curricular activities; and

- Parenting time (formerly known as “visitation.)

Parents can either have joint decision-making responsibility for their kids for each of the areas noted above, or one of them can have decision-making responsibility for that area. (So one parent could make decisions about education and the other could make them about health care, etc.)

Both parents are entitled to have parenting time with their children. In Illinois, the law recognizes that it is in the children’s best interest to have a relationship with, and spend time with, both parents. How parenting time is configured, however, is different in every case.

7. Is there a standard visitation schedule in Illinois divorces?

There is no “standard” parenting schedule that applies in every case. There is no law or rule that determines how much time fathers or mothers get to spend with their kids after a divorce.

In most cases, parents see their children based upon a schedule that they agree upon. If the parents can’t agree on a parenting time schedule, then the court will determine the schedule upon which each parent will see the kids.

The court makes its parenting time determination based upon what the judge finds to be in the best interest of the children. What is in the children’s “best interest” depends on the facts and circumstances of every case.

8. What happens if my ex doesn’t pay child support in Illinois?

In general, child support orders are enforced in court. So, if your ex isn’t paying child support, you need to go back to court and ask the judge to find your ex in contempt of court.

If your ex is found to be in contempt of court, the judge can impose penalties on your ex for not paying the support s/he was supposed to pay. The judge can also put your ex in jail until s/he comes up with at least some portion of the back child support that is due. The judge can also order your ex to pay the attorney’s fees you incurred in having to chase him/her down for the child support payments that were due.

Enforcing child support orders can be a long and tedious process. It takes time and it costs money. However, the State’s Attorney in your county may represent you in a child support collection case for free. Contact your local State’s Attorney’s Office if you are interested in that service.

NOTE: The ONLY thing that the State’s Attorney will represent you on is child support enforcement. If you want to argue with your ex about any issue other than child support, that’s on you.

9. What is the "Right of First Refusal," and do I need this in my Parenting Plan?

The "Right of First Refusal" is a parent's right to to be asked to babysit for his/her child BEFORE anyone else can do so. For example, if it's your day to have parenting time with your kids, and you want to go out for a few hours, with the right of first refusal you would have to call your ex and ask him/her to babysit before you ask anyone else to do so. If your ex says, "No," THEN you can ask someone else to watch them.

Every divorcing Illinois parent needs to deal with the right of first refusal in his/her parenting plan. If you have older children, you may not want or need to have a right of first refusal for your kids. But, because Illinois law requires you to deal with this issue, you at least have to say that you and your ex agreed NOT to make this part of your parenting plan.

While dealing with the right of first refusal in an Illinois divorce is required, the WAY you deal with that right can vary greatly.

For example, some parents want to have the right to babysit their kids if the other parent is gone for an hour or more. Others don't want the right to kick in unless one of them will be gone overnight. Still others may want grandparents to be considered when dealing with this right. (i.e. You only get the right to babysit the kids if neither their other parent nor their grandparents are available to stay with them.) This gives grandparents a greater opportunity to spend time with their grandchildren.

How you configure the right of first refusal in your divorce is up to you. If you and your spouse can't agree on the terms of this right, however, the court will decide it for you.

Alimony in Illinois

1. Will I get (or have to pay) alimony if I divorce in Illinois?

Alimony in Illinois is known as maintenance.

Whether you will get (or have to pay) maintenance/alimony in Illinois depends first upon whether your case is one in which maintenance is appropriate.

To determine whether maintenance is appropriate the court must first consider a variety of different factors. (CLICK HERE to see the full list of factors the court considers in determining maintenance/alimony.)

If maintenance is appropriate in your case then the court applies a guideline formula to calculate how much spousal support should be paid, and how long it should be paid for. This formula is now based upon you and your spouse’s NET income(s).

To get more information about how the Illinois maintenance formula works (i.e. how long maintenance lasts and how much should be paid) CLICK HERE.

To get a more precise idea about how much maintenance you might have to pay, or might receive, in your case, consult with an Illinois divorce financial planner or accountant.

2. Will I get more money in my divorce if my spouse cheated on me?

No.

In Illinois, marital misconduct (i.e., cheating) has NO effect on how property in a divorce is divided.

The only exception is if your spouse used marital money for a non-marital purpose. For example, if your spouse spent money taking his/her new love interest out to dinner, or on vacation, that money is considered to be “dissipation.”

Your spouse may have to pay the marital estate back for amounts s/he dissipated during your marriage. However, the rules surrounding dissipation can be complicated. If you have questions about whether dissipation may be an issue in your divorce, consult with an Illinois divorce attorney to get more information.

3. How many years do you have to be married to get spousal support (i.e. maintenance)?

You don’t have to be married for any certain amount of time in order to get maintenance in Illinois. However, the amount of time during which you are entitled to receive maintenance depends upon the amount of time you were married.

The longer you were married, the longer the period of time you may be entitled to receive (or may have to pay) maintenance.

To see a table that shows how long you may be entitled to get spousal support based upon the length of your marriage, CLICK HERE.

4. What is the average amount of alimony in Illinois?

In Illinois family law, alimony is based upon the amount of money you and your spouse make.

There is no “average” amount of alimony that's granted in every case.

Other Illinois Family Law Questions

1. How much does a divorce cost in Illinois?

The answer is: It depends.

The biggest part of your divorce costs will usually be your attorney’s fees. Attorneys charge by the hour for their time. The more you fight, the more hours your attorney will have to spend fighting, so the more your divorce will cost.

Also, the more time your lawyer has to spend sorting through your financial situation, the more you will pay your lawyer. So if your financial situation is complicated, your divorce will likely be more expensive than it would if your finances were simple.

Other things that drive up the cost of divorce are expert fees. If you have to pay a forensic accountant, or a business evaluator, or a child psychologist, their fees will also make your divorce cost more.

2. How long will my Illinois divorce take?

Again, the answer is: It depends.

The more you and your spouse fight, the longer your divorce will take. (And, if you fight, your divorce can take a LONG time!) But, there are also other things that will drag out your divorce.

If you need to get your business or real estate appraised before you can resolve your divorce, that usually makes your divorce take longer. If you have to get a psychologist involved in your divorce because of disputes about your kids, that usually makes your divorce take longer.

Another thing that can drag out your divorce is the discovery process. If your spouse won’t produce financial documents, and you have to send subpoenas to banks, credit card companies, etc. to get the information you need, that can add enormous amounts of time to your divorce, too.

3. How do you deal with health insurance when you divorce in Illinois?

Each spouse is generally responsible for getting his/her own health insurance after a divorce. In some cases, one spouse can agree to pay for another’s health insurance premiums for a certain period of time after a divorce. The payment of those premiums may or may not be considered to be “maintenance.”

If a couple gets their health insurance through one spouse’s employer, it may be possible for the other spouse to get continued coverage through COBRA. That coverage can last up to 36 months after a divorce. However, the premiums are usually not cheap!

If one spouse wants to continue to keep the other on his/her health insurance after the divorce, you need to check with the health insurance provider to see if that’s allowed. Most health insurers do NOT allow divorced spouses to maintain the same health insurance.

As for the kids, in Illinois, one parent or the other will generally be required to get health insurance for the children. One or both of the parents may be required to contribute toward the payment of the kids’ health insurance premiums.

4. Does Illinois recognize common law marriage?

No.

5. How do I get a simple divorce in Illinois?

A joint and simplified divorce in Illinois is a special divorce process that’s available under Illinois family law if you have no children, little money, and you and your spouse agree on everything in your divorce. To get a joint and simplified divorce you must meet these requirements:

- You or your spouse must have lived in Illinois for at least 90 days before you filed for divorce;

- You and your spouse have to agree that irreconcilable differences have arisen between you and that you want a divorce;

- Neither you nor your spouse can ask for maintenance (spousal support);

- You can’t have children;

- The wife can’t be pregnant by the husband;

- You’ve been married for less than 8 years;

- Neither you nor your spouse owns any real estate;

- You and your spouse have NO joint retirement benefits and the combined amount of any individual retirement benefits you have is less than $10,000;

- The value of everything you own (after subtracting what you owe on that property) is less than $50,000;

- Neither you nor your spouse earns more than $30,000 per year, gross;

- As a couple, you and your spouse do not earn more than $60,000 per year, gross;

- You and your spouse have each disclosed all of your assets and debts to each other;

- Both you and your spouse have copies of all of the tax returns either of you filed during your marriage;

- You and your spouse have both signed a written settlement agreement dividing all of your property worth more than $100 and all of your debts;

- You and your spouse have both signed a written settlement agreement outlining who will own and be responsible for all of your pets.