Two things most sane people seek to avoid are divorce and taxes. Unfortunately, when you’re going through a divorce, not paying attention to taxes can cost you thousands. That’s especially true with the tax law changes that went into effect in 2018 and 2019. Now more than ever, not understanding how taxes will affect your divorce can be a very expensive mistake.

The Basics of Divorce And Taxes

Divorce changes your tax status. Married filing jointly is the most tax-favored way to file taxes. Once you’re divorced, you will lose that status.

Lots of people think that as long as they were married for some part of the year, they can still file taxes as married filing jointly. That’s not true.

Your marital status for income tax purposes is determined as of December 31. If you were already divorced on December 31 your only options are to file either as a single person, or head of household.

To secure the most favorable tax treatment, many people wait until January 1 to get divorced. That allows them to file income taxes as a married couple in the previous year. Yet, like everything else in divorce, whether waiting until January 1 makes financial sense for you or not depends! It depends on your total financial situation. It also depends on what time of the year it is when you’re having this discussion.

If you’re ready to divorce in November, then waiting until January to get divorced might make sense.

But if you’re ready to divorce in April, it probably doesn’t!

(Plus, while filing taxes with your ex may make financial sense, it will also require you to DEAL with your ex in the process! If that thought makes you crazy, you may need to weigh the financial benefit of paying less taxes against the emotional burden of having to continue to do taxes with your ex one more time.)

Paying Taxes on Alimony and Child Support

Historically, alimony (also known as maintenance or spousal support) was tax-deductible to the person who paid it. The person who received alimony was the one who paid the tax on the income.

This was known as the alimony tax deduction, and it often made settling divorce cases easier. That’s because the spouse who received alimony was usually in a lower income tax bracket than the spouse who paid alimony. The alimony tax deduction allowed the couple to shift income from the higher earner to the lower earner. As a result, both spouses paid less in taxes than they otherwise would have paid.

Unfortunately, effective January 1, 2019, Congress eliminated the alimony tax deduction.

Now alimony, like child support, is no longer tax-deductible to the person who pays it.

That means that if you’re paying alimony to your spouse you get hit with a double-whammy. First, you have to pay taxes on the income you earn at your income tax rate. Then you have to use your post-tax dollars to pay spousal support to your ex.

While this may seem like this tax law change created a windfall for the receiving spouse, in truth, the opposite has occurred.

Because the paying spouse now has to pay taxes (at his/her higher tax rate) courts now give the receiving spouse less money.

The bottom line is that this tax law change negatively affected BOTH the spouse who pays, adn the spouse who receives, alimony.

8 Ways the Tax Laws Can Negatively Impact Your Divorce

1. Personal Exemptions

Before 2018, when you filed your taxes, you got to claim yourself, and each of your kids, as dependents on your taxes. Known as “personal exemptions” or “dependency exemptions,” these tax breaks allowed you to subtract a certain amount of money from your taxable income for every dependent you claimed. The more dependents you claimed, the more money you could subtract.

While this dependency exemption wasn’t available to high-income-earners, it was available to everyone else.

Unfortunately, the dependency exemption is now gone … for a while.

From 2018 through 2025, no one gets a tax exemption for claiming the kids as dependents. But then in 2025 (theoretically, at least!) the dependency exemption will spring back to life.

That means that it’s still something that smart divorcing couples have to deal with.

How This Could Affect Your Divorce

Before 2018, divorcing couples often argued over which of them got to claim the kids as dependents on their income tax returns after the divorce. Kids could typically be listed as dependents on their parents’ income tax returns until they turned 18, or graduated from college. However, each child could only be claimed as a dependent by one parent.

At first blush, the fact that the dependency exemption no longer exists might seem like good news for divorcing couples. If no one gets to claim the kids as dependents, that’s one less thing to fight about, right?

Not exactly.

Although neither parent will get a tax exemption for claiming the kids as dependents through 2025, theoretically, that will change in 2026. So, if your children will still be underage in 2026, you and your soon-to-be-ex still need to decide who gets to claim the dependency exemption for them from 2026 on.

What’s more, even if your kids are older, if they’ll still be in college after 2025, the ability to claim them as a dependent might still bring a financial benefit to the parent who claims them.

Finally, while the dependency exemption itself may not be worth anything for a few more years, deciding which parent can claim which child as a dependent may affect the child tax credit.

The bottom line is that, divorcing parents still need to decide which parent is entitled to claim which child as a dependent in any given year.

2. Child Tax Credit

Another tax benefit available to parents is the child tax credit. Before 2018, that tax credit lowered the amount of taxes that parents paid by $1,000.00 per “qualifying child.”

There were 7 requirements for determining who was a “qualifying child”.

The child …

- … must be under age 17;

- … has to be your biological child, a stepchild, an adopted child, or a foster child;

- … cannot provide more than half his/her own support during the tax year;

- The parent seeking the credit had to claim the child as a dependent;

- … has to be a U.S. citizen, a U.S. national or a U.S. resident alien;

- … must have lived with the parent claiming him/her for more than half the year;

- The parent can’t make more than a certain amount of money.

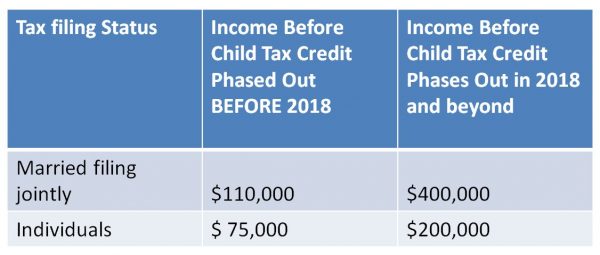

In 2018, Congress increased the amount of the child tax credit to $2,000. They also dramatically increased the amount of money that parents could make before the child tax credit gets phased out.

In 2020, the amount increased to $3,000 per child under age 8 or $3,600 per child under age 6. In 2021, parents may be able to receive advance payments of the child tax credit up to $250 for a child under age 18 or $300 for a child under age 6.

How This Could Affect Your Divorce

In spite of all these changes, Congress did NOT change the rules for figuring out who is a “qualifying child.” As a result, negotiating this child tax credit in divorce can be confusing.

What’s more, even though the dependency exemption has no value (at least through 2025) unless a parent has the right to claim a child as a dependent, that child might not qualify for the child tax credit on that parent’s income taxes. That’s why, in your divorce, you still need to negotiate which parent can claim each child as a dependent in every year.

If you don’t say who can claim the child as a dependent, you risk losing the child tax credit. That can be a big deal. Why?

The child tax credit directly reduces the amount of income tax you pay. So, it doesn’t just reduce your taxable income. It reduces your taxes. And, let’s face it. Who wouldn’t want to pay thousands of dollars less in taxes per year?

3. The Importance of Claiming the Children on Your Taxes if You Get Health Insurance on the Exchange

If you get health insurance for yourself and your kids through the Health Insurance Exchange, then the government is subsidizing a portion of your health insurance premiums. You’re paying less and the government is picking up the tab.

However, if you make more money in any given year than what you estimated you would make, then you may have to repay the government all, or some portion of, the premiums it paid on your behalf.

That alone makes estimating your annual income accurately super important. It’s even more important, and harder to do, though, when you’re divorced.

How This Could Affect Your Divorce

Not considering how claiming the children on your taxes can impact the health insurance you get for them on the Health Insurance Exchange has become an expensive trap for the unwary.

Most divorcing spouses agree to split the right to claim their children on their taxes in any given year. So either, mom gets to claim the kids in even years and dad gets to claim them in odd years, or mom gets to claim Child A, Dad gets to claim Child B, and they alternate claiming Child C. Doing this is easy and it seems fair enough.

But if dad claims Child B on his income taxes while mom gets health insurance for Child B through the health insurance exchange based on her taxes, mom might end up having to repay the government for that portion of Child B’s health insurance that the government subsidized! The same thing is true if mom claims the kids on her taxes in one year, but dad gets health insurance for the kids through the exchange based on his income.

The bottom line is that negotiating the dependency exemption and the child tax credit can be trickier than they seem. To avoid facing an expensive and unpleasant surprise in the future, it’s wise to consult with a tax adviser or a divorce financial planner about this issue BEFORE you finalize your divorce.

4. Education Expenses (529 Plans)

Another new tax law change is the change to 529 Plans.

529 Plans are special tax-advantaged savings accounts that parents (or grandparents) could create to save money for children’s college educational expenses.

In the past, 529 Plans could only be used to fund “Qualified Higher Education Costs.” That’s IRS speak for college/university tuition and certain other college or university expenses. If you used the money in a 529 Plan to pay for anything else, you had to pay a penalty on the money you used.

Under the new tax laws, parents can take up to $10,000 per year out of a child’s 529 Plan and use it to pay for that child’s elementary or secondary school tuition.

How This Could Affect Your Divorce

Like most parents, if you have 529 Plans set up for your kids, you probably assumed that the money that you were setting aside would go to pay for your kids’ college. Because there were penalties for using the money for any other purpose, in the past, most parents left their kids’ 529 Plans alone in divorce.

Now, if your kids are going to private school, you or your spouse could want to use the kids’ college money to pay for it. That will save you from having to pay the private school tuition yourselves.

It will also leave your kids with less money (or no money) to pay for college.

The bottom line is that deciding what to do with your kids’ 529 Plans is now one more thing you’ve got to negotiate in your divorce.

5. Moving Expenses

It goes without saying that, when a couple divorces, at least one of them moves out. Many times, the person who moved out also got a new job.

Before 2018, if you were moving because of a new job, you could deduct your moving expenses from your taxable income. Now, you can’t.

How This Could Affect Your Divorce

While paying for moving expenses may not be a huge issue in your divorce, the truth is: moving costs money. Since there is probably no way you will ever get to deduct those moving expenses from your taxes, you might want to think harder now about how you will pay for those expenses when you divorce.

If possible, you may also want to negotiate who will pay for those expenses as well.

6. Mortgage Interest & HELOC payments

Under the current tax law, you can deduct the interest you pay on your home mortgage on your taxes. In the past, that deduction was limited to the interest you paid on the first $1,000,000 of your loan. But, you could deduct that interest if it was on any kind of a mortgage or home equity loan. It didn’t matter if you actually used the money to pay for your home or pay off your credit cards.

That’s all changed now.

From now on, the new tax law limits the mortgage interest deduction to interest paid on the first $750,000 of your loan. To be deductible, the loan must also be used to buy, build, or substantially improve the home that secures the loan. That applies to home equity loans and lines of credit, too.

How This Could Affect Your Divorce

By making mortgage interest non-deductible unless you use the money for your home, the IRS has now closed a potential means of cash flow that often made settling your divorce easier.

Here’s why.

In the past, if a divorcing couple had a home equity line of credit that wasn’t maxed out, they could draw on that loan in their divorce. They could then use that cash to pay for their divorce expenses. Or, they could use it to balance out their property settlement or pay moving expenses.

When they withdrew that money, they could deduct the interest they paid on it from their taxes.

Now, you can still draw on your home equity line of credit in your divorce. But, if you use the money to pay for anything besides home improvements, any interest you have to pay will not be tax-deductible.

7. State and Local Tax Payments

Real estate taxes can be hefty. Before 2018, you could deduct the amount you paid in real estate taxes on your federal income taxes. You could also deduct what you paid in state income tax, sales tax and other state and local taxes.

Not anymore.

From 2018 on, you can only deduct the first $10,000 you pay in state and local taxes, including income taxes, real estate taxes and sales taxes.

How This Could Affect Your Divorce

If you’re thinking of keeping your home when you divorce, you’ve got to figure out if you can afford it. Hopefully, you figure that out first, before you finalize your divorce!

Not being able to deduct the full amount of the property taxes you pay can potentially cost you more in income taxes. That increases your expenses and reduces your cash flow. While it might not seem like a lot, money is tight after a divorce.

Those extra expenses can also tip the balance in your finances. and make keeping your home unrealistic.

Remember, too, that you can only deduct your property taxes if you itemize your deductions. Right now, a lot of the things you used to be able to claim as deductions before 2018 are gone. As a result, many people can’t itemize their deductions anymore. If you can’t itemize your deductions, you can’t deduct any property taxes you pay from your income.

The bottom line is that, before you negotiate to keep your house in your divorce, you would be wise to consult with a divorce financial planner or accountant to make sure that you can actually afford to do that.

8. Medical Expenses

Most of the new tax law changes we’ve discussed affect divorce fairly negatively. The changes to the medical expense deduction, however, are positive (at least for now).

Before 2018, you could only deduct medical expenses that exceeded 10% of your adjusted gross income. Now, however, you can deduct medical expenses that exceed 7.5% of your income.

While that 7.5% threshold was supposed to go back up to $10,000 in 2019, it didn’t. So for now at least, you can still deduct medical expenses that exceed 7.5% of your income.

Of course, in order to be to deduct medical expenses at all, you have to be able to itemize your deductions. If you don’t, then you’ll lose this deduction too.

How This Could Affect Your Divorce

If you have a lot of medical expenses, and you are getting divorced, the lower-income threshold for deducting medical expenses can be good news. First, when you divorce you can no longer file taxes with your spouse. So, you will have less income to declare on your taxes. Since you can deduct expenses that exceed 7.5% of your income, that means you will likely get more deductions.

All of this could ease the cash flow crunch that divorce usually causes.

The bad news, of course, is that the 7.5% threshold might go back up to 10% in the future. Even still, it will be nice while it lasts.

The Bottom Line When it Comes to Divorce and Taxes

Divorce and taxes are complicated. The tax laws change all the time. Trying to anticipate how to minimize your taxes after divorce can be tricky.

Because of all that, it’s vitally important that you consult with a tax expert BEFORE you finalize your divorce. If you wait until your divorce is over, you may end up in a bad situation that you can’t change.

Even if you are just thinking about divorce, you should talk to an accountant or a divorce financial planner now. They can point out problems in your finances that you might not otherwise see.

A settlement that looks great on paper, won’t be nearly as good if it costs you more in taxes than you expected.

The bottom line is that understanding divorce and taxes is one of the most important things you can do to secure your financial future.

____________

This article was originally published on February 23, 2018 and updated on April 7, 2021.

Nothing in this article should be considered as tax advice. Please consult with a qualified tax adviser or accountant for tax advice that will apply in your specific situation.

Thank you for taking time to write and provide this information. I am recently divorced after 25 years from an attorney. After financially putting him through law school, and 3 grown beautiful daughters. I lost everything and found out everything was in my name including my kids college loans. The only thing together was the house and truck were both of our names. I was totally stupid. He refused to sell the house and refused to file bankruptcy. I was a good attorney’s wife (and said nothing to anyone for over 2 years) and I could seriously write a book. Lastly I recommend those to read “Too Good to Leave Too bad to Stay” by Mira Kirshenbaum. I don’t regret leaving but so wish I did it 6 years ago. I am 46 and starting all over. Trying to keep my head up when I go to church and the funny thing not one person ever contacted me from the church until it was over. God never gives what you can’t handle. Right? It’s been tough! My girls say mom you stay strong! Divorce is just not fun! Thank you Karen!

You’re so welcome! And you’re right: you’re stronger than you think!

Hang in there! Life will get better!

Best,

Karen

PS I agree with you about “Too Good to Leave, Too Bad to Stay.” It’s excellent. Here’s a link if anyone is interested: Too Good to Leave Too Bad to Stay

This is an outrageous story of laws that do not acknowledge marriage as a financial partnership. Even more peculiar is that some states, like my own New Jersey, has taken the extreme opposite track of Indiana”s. In NJ, alimony for a marriage like Lori Vanatsky, would have been permanent, for life, no incentive for the supported spouse to move on with their lives. It seems to me that there should be a balanced middle ground, which I very much hope that Indiana will pursue. Somewhere between NO alimony and PERMANENY alimony lies an equitable position that strikes the balance of a fair amount of support until a spouse can get on their feet, but still provides an incentive to get on with life. Kudos to Lori Vanatsky. She proves that moving on is possible. Lori is a role model.

I agree. A middle ground would be best.

Here is a link to the Lori Vanatsky story for anyone who might not be familiar with it.

CLICK HERE for the story.

Karen